Workers Comp Settlement Chart Ct

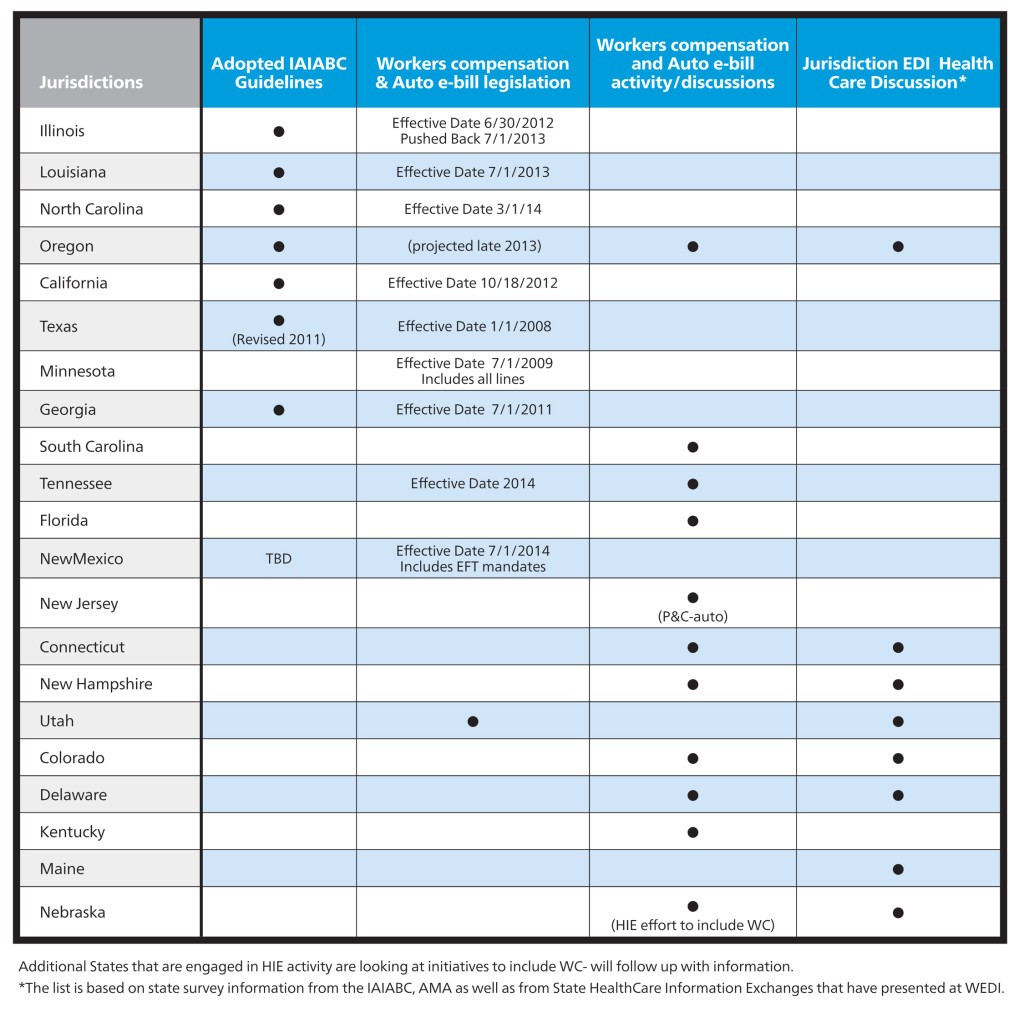

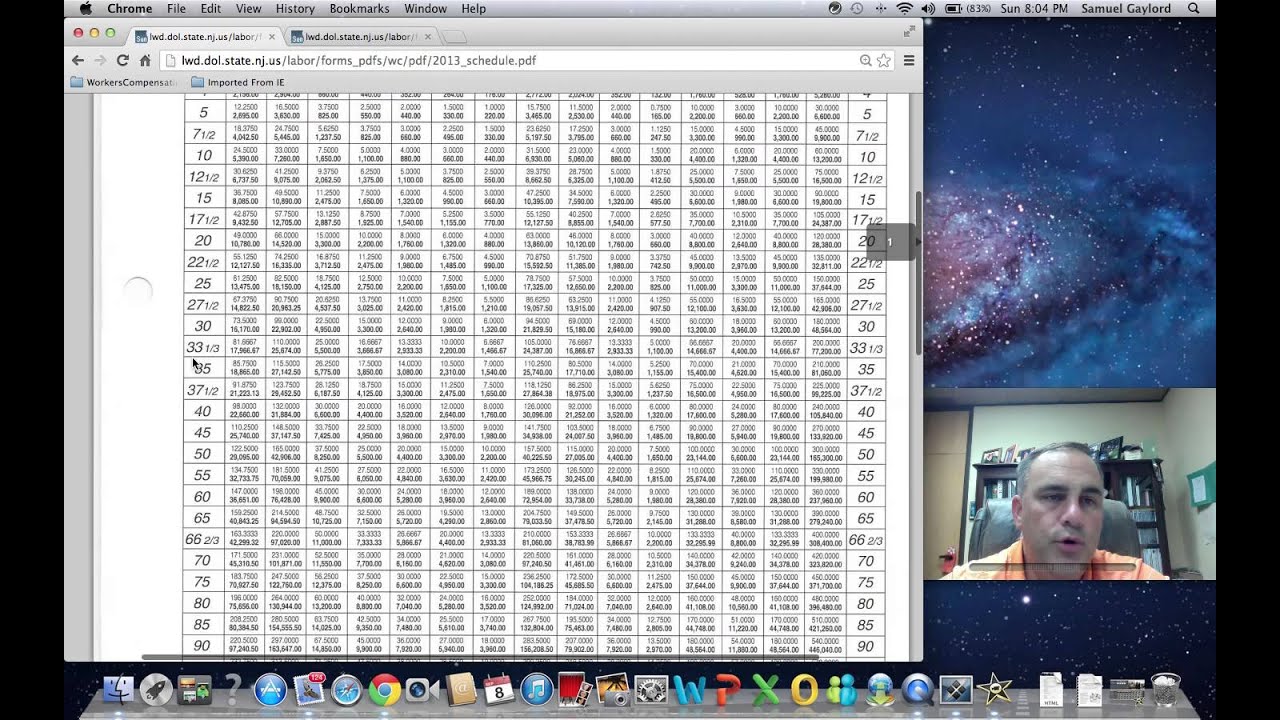

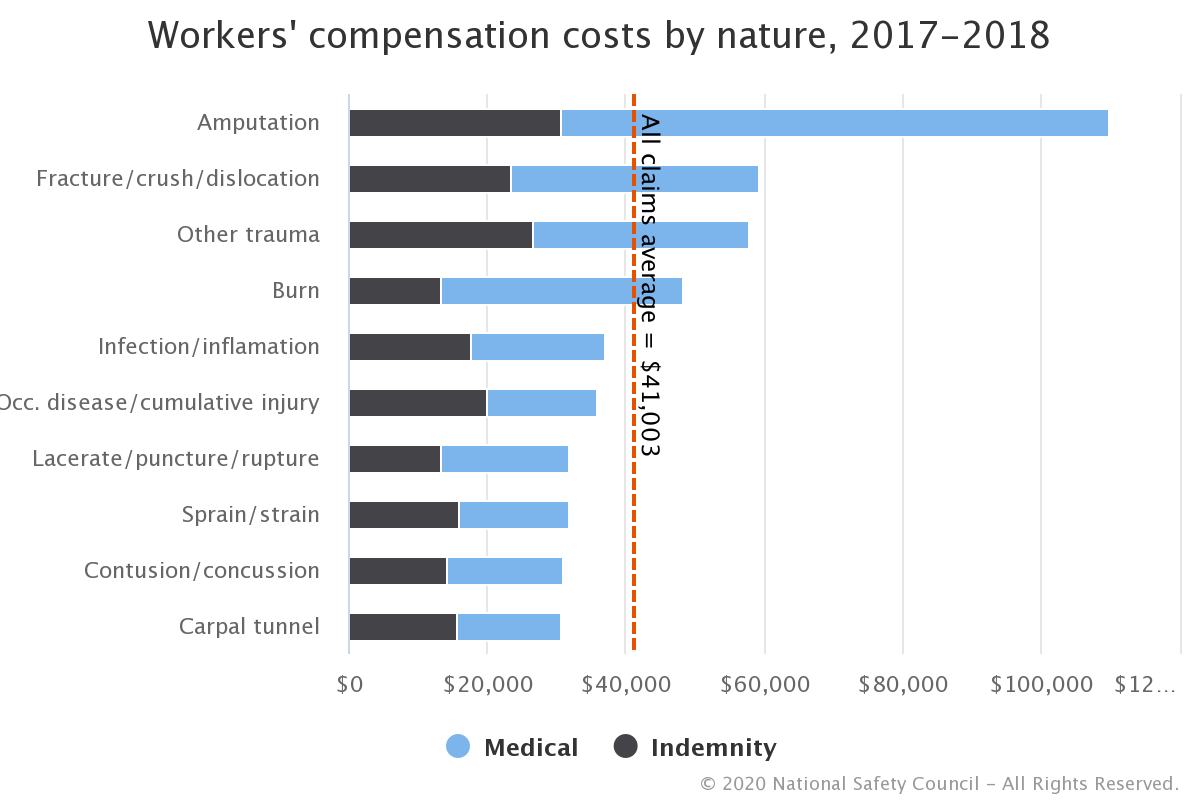

Workers Comp Settlement Chart Ct - Calculating weekly benefit amounts without fica and/or medicare deductions. This chart takes into account various factors such as the severity of the injury, the expected recovery time, and the worker's average weekly wage. The cost for the tables through budget printers is as follows. The specific body part that was injured. Types of connecticut wc payments. But in general, most settlements fall somewhere between $2,000 and $50,000, with an average workers' settlement of just over $20,000. Web tables for determining the workers' compensation benefits for connecticut workers injured between october 1, 2021 through september 30, 2022 are now available. As you might expect, workers' comp settlement amounts vary widely depending on the severity of the injury. Connecticut’s 137 wc statutes are known collectively as the wc act, or chapter 568. Web at the the malowitz law firm, llc, i have over two decades of experience representing injured clients in personal injury and workers’ compensation cases. But in general, most settlements fall somewhere between $2,000 and $50,000, with an average workers' settlement of just over $20,000. This chart takes into account various factors such as the severity of the injury, the expected recovery time, and the worker's average weekly wage. Calculating weekly benefit amounts without fica and/or medicare deductions. The amount you have already received in benefits. $678 per week versus $631 in massachusetts, $503 in rhode island, $496 in new jersey, and $400 in new york. Web this is a simplified chart representing the basic steps through a “typical” undisputed workers’ compensation case, including the main events in the life of a claim and the corresponding actions taken by the injured/ill employee, the Payment by check is required. As you might expect, workers' comp settlement amounts vary widely depending on the severity of the injury. Web connecticut office of the state comptroller. Weekly workers ’ compensation benefit. A settlement removes the uncertainty that comes with a hearing—especially if there's a legitimate dispute about the extent of your injuries. Web part 6 calculate the weekly workers ’ compensation benefit as follows: Calculating weekly benefit amounts without fica and/or medicare deductions. These tables can be obtained from: Types of connecticut wc payments. These tables can be obtained from: The specific body part that was injured. Types of connecticut wc payments. How much do workers’ compensation claims cost? A workers’ comp settlement can end with one lump sum amount or a structured payment plan. Determine whether maximum or minimum compensation. Web the value of a particular workers’ compensation case can vary depending on many factors. The cost for the tables through budget printers is as follows. Sers annual disability retirement survey; These tables can be obtained from: Web connecticut’s workers' compensation commission administers their wc. These tables can be obtained from: This chart takes into account various factors such as the severity of the injury, the expected recovery time, and the worker's average weekly wage. View a sample of my successful verdicts and settlements in the following categories: A workers’ comp settlement can end with one lump. Weekly workers ’ compensation benefit. Web a settlement is a way to resolve your workers' comp case without a formal hearing. Office of the state comptroller. Calculating weekly benefit amounts without fica and/or medicare deductions. The amount you have already received in benefits. This chart takes into account various factors such as the severity of the injury, the expected recovery time, and the worker's average weekly wage. The specific body part that was injured. Web learn the risks and benefits of settling your workers' comp claim, and what amount you can expect from the settlement. $678 per week versus $631 in massachusetts, $503. The cost for the tables through budget printers is as follows. Web a settlement is a way to resolve your workers' comp case without a formal hearing. Web connecticut's workers' compensation act, or chapter 568 of the connecticut general statutes, as amended to january 1, 2022. Sers annual disability retirement survey; Web tables for determining the workers' compensation benefits for. Web connecticut's workers' compensation act, or chapter 568 of the connecticut general statutes, as amended to january 1, 2022. Payment by check is required. Section 31 covers indemnity payments. Filing this “written notice of claim” puts your claim on record. Sers annual disability retirement survey; Web although connecticut's benefit rate is one of the lowest, many connecticut claimants still receive higher benefits because connecticut has the highest maximum benefit rate of any of the surrounding states: Calculating weekly benefit amounts without fica and/or medicare deductions. Web how much is the average workers' comp settlement? Web at the the malowitz law firm, llc, i have over. Determine whether maximum or minimum compensation. Web what is a workers comp settlement chart and how does it work? Weekly workers ’ compensation benefit. Web a settlement is a way to resolve your workers' comp case without a formal hearing. Types of connecticut wc payments. Web how much is the average workers' comp settlement? Connecticut’s 137 wc statutes are known collectively as the wc act, or chapter 568. Web workers' compensation benefits fall into two categories: Office of the state comptroller. A settlement removes the uncertainty that comes with a hearing—especially if there's a legitimate dispute about the extent of your injuries. Types of connecticut wc payments. Web learn how workers' compensation settlements work, how much workers' comp settlement amounts usually are and what an employer's role should be in the settlement process from the hartford. Determine whether maximum or minimum compensation. As you might expect, workers' comp settlement amounts vary widely depending on the severity of the injury. Web part 6 calculate the weekly workers ’ compensation benefit as follows: Web the value of a particular workers’ compensation case can vary depending on many factors. Web what is a workers comp settlement chart and how does it work? Web workers’ compensation benefit rate tables: It serves as a reference point for determining the amount an injured worker might expect to receive for their claim. Payment by check is required. The amount you have already received in benefits.Workers Comp Settlement Chart Ct

Workers Comp Settlement Chart Ct

Workers’ Comp Settlement Calculator Estimate Your Claim Value

Workers Compensation Settlement Chart

Workers Comp Settlement Chart

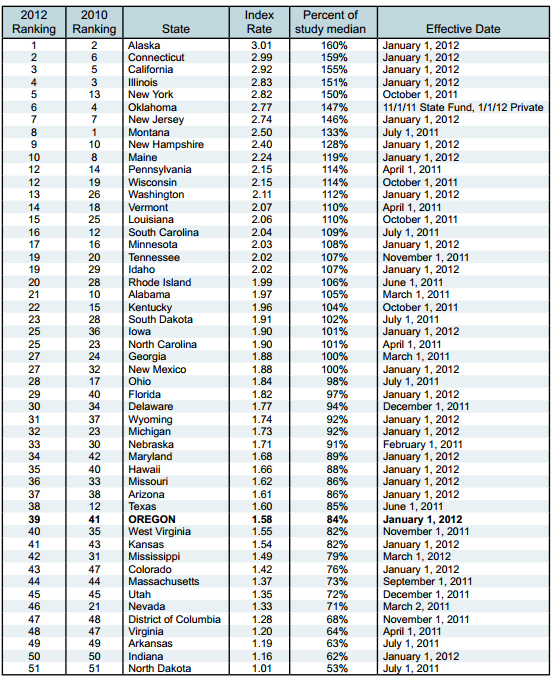

Connecticut Workers’ Comp Second Most Expensive in Nation Study

Workman's Comp Settlement Chart

Workers Comp Settlement Calculator What Is My Case Worth? [Call 312

Workers Compensation Settlement Chart

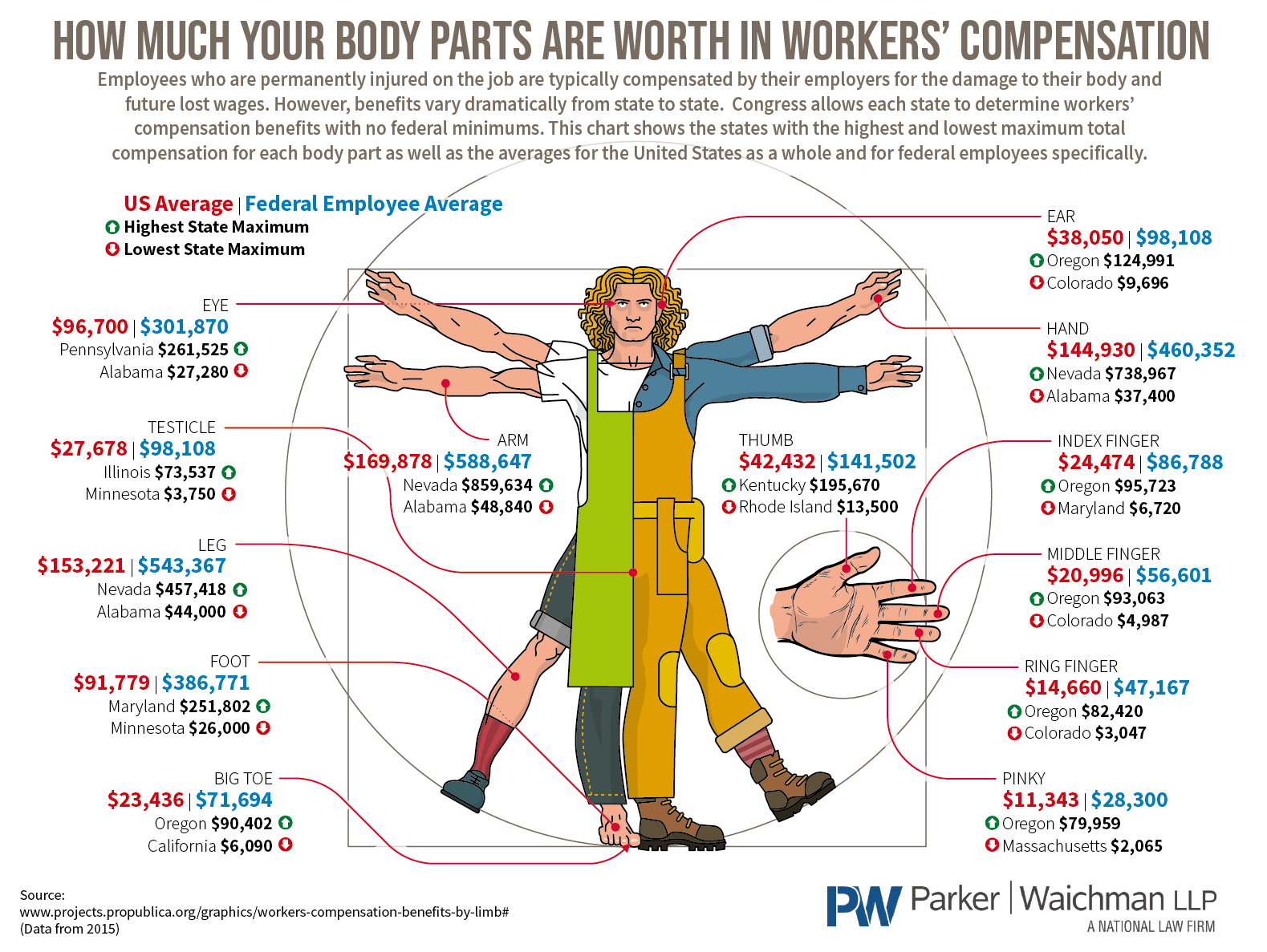

Body Part Workers' Comp Settlement Chart

These Tables Can Be Obtained From:

This Chart Takes Into Account Various Factors Such As The Severity Of The Injury, The Expected Recovery Time, And The Worker's Average Weekly Wage.

Sers Annual Disability Retirement Survey;

Web Although Connecticut's Benefit Rate Is One Of The Lowest, Many Connecticut Claimants Still Receive Higher Benefits Because Connecticut Has The Highest Maximum Benefit Rate Of Any Of The Surrounding States:

Related Post: