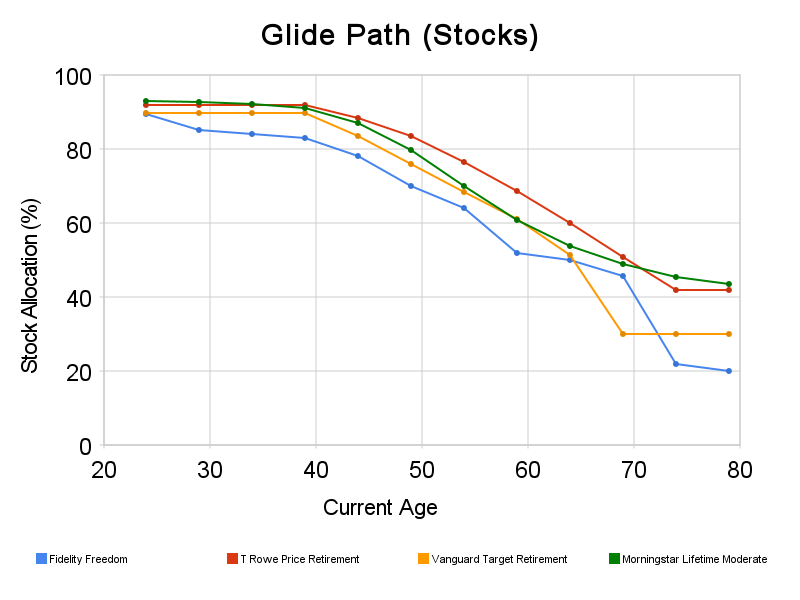

Glide Path Chart

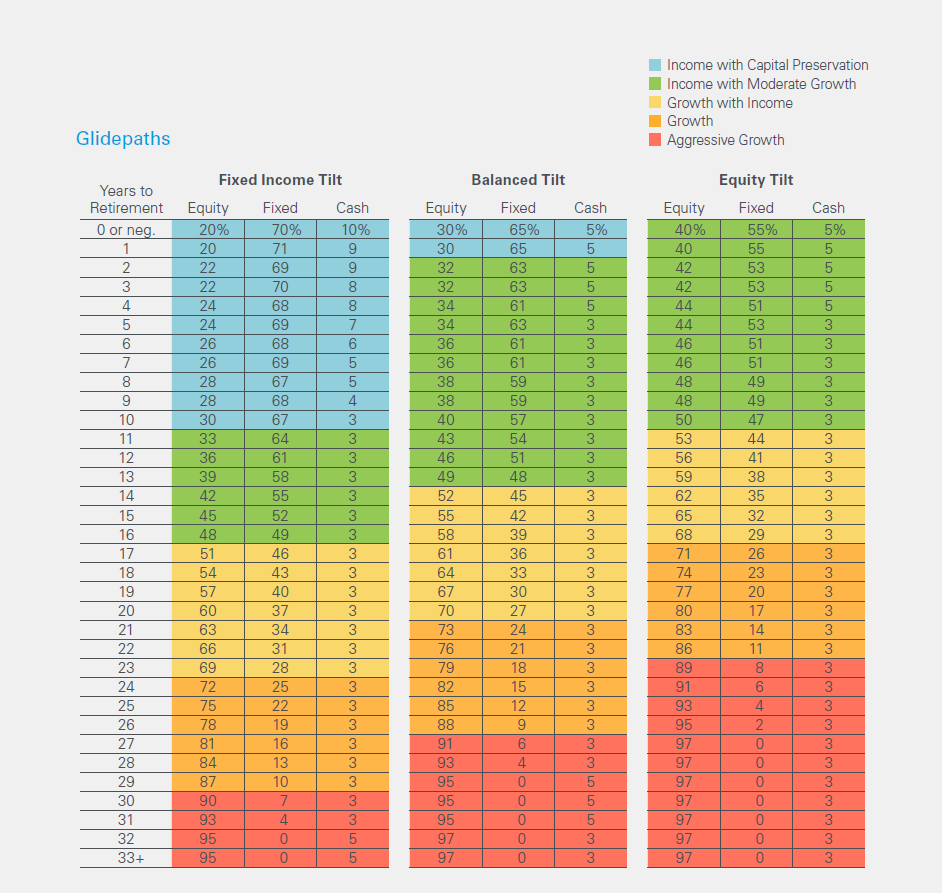

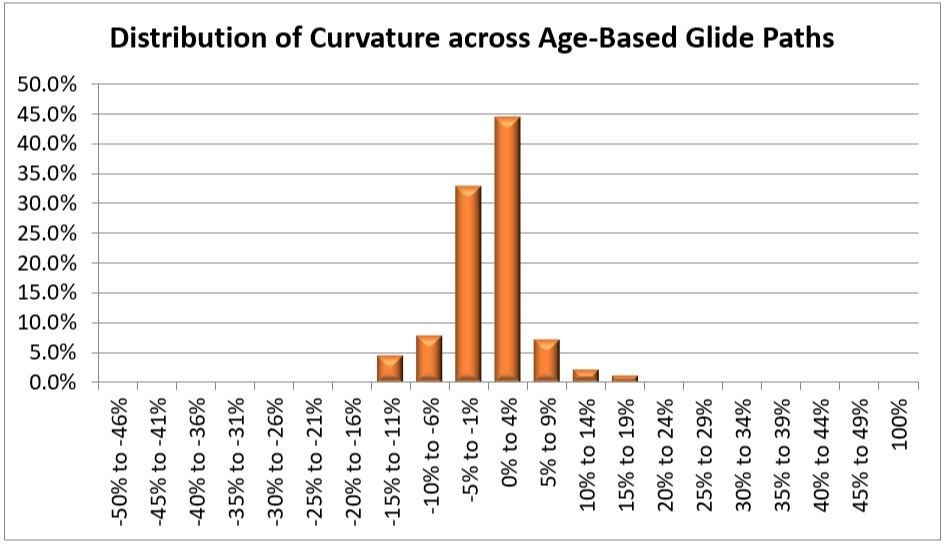

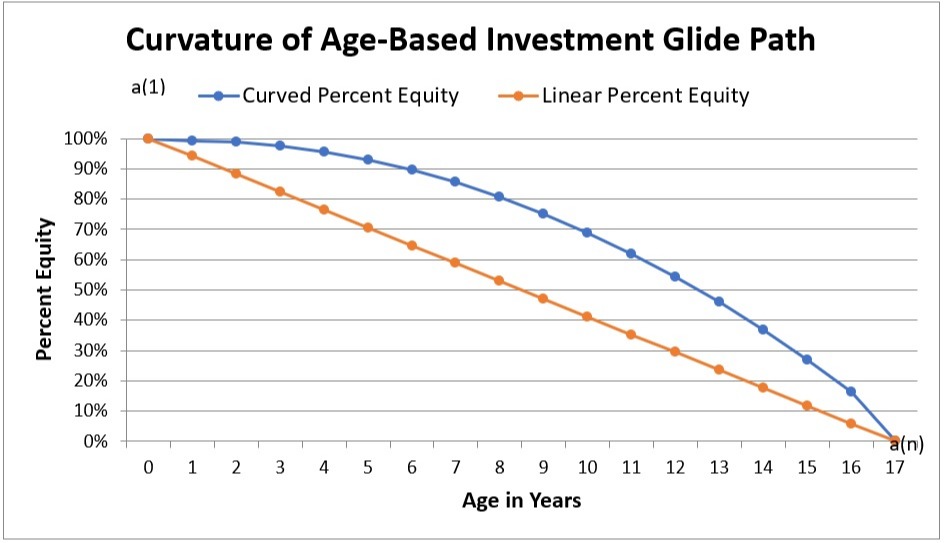

Glide Path Chart - Web an equity glide path refers to the changes to the equity portion of your asset allocation over time. (1) static glide path, (2) declining glide path, and (3). Web a glide path is the change in a target date fund’s asset mix as time goes by. Web a target retirement fund will—automatically—rebalance over time via its glide path. Its purpose is to optimize returns and manage. When improving our kpi, each change in the planned performance should align with the expected completion of an. Web the glide path formula is a method for calculating how the asset allocation of an investment portfolio should change over time. View the sample bubble chart to tell if your retirement plan is right for participants. Web a glide path is simply the way the asset mix within a target date fund changes over time. Linear glide paths involve a gradual shift in asset allocation over time, step glide paths involve a. Those that go to the target date, when the fund typically keeps the same asset mix throughout retirement, and those that go. Web this is commonly known as a glide path. As investors navigate the terrain of. There are three main types of glide paths: Linear glide paths involve a gradual shift in asset allocation over time, step glide paths involve a. Web if you've been looking to add a new and visually appealing element to your data visualization game in excel, look no further than the glide path chart. I then calculate the median and the 25th and 75th percentile equity level across each age. View the sample bubble chart to tell if your retirement plan is right for participants. Typically, the mix gets more conservative — with fewer stocks and. Web in the investment world, the term glide path refers to the process by which a target date fund changes its asset allocation among risky assets (which can include. Web an equity glide path refers to the changes to the equity portion of your asset allocation over time. Our changing emerging markets equity exposure is an example of this. Web the three types of glide paths are linear, step, and custom. Allocation between own, loan and reserve super classes will determine the bulk of your investment returns. Web based. Those that go to the target date, when the fund typically keeps the same asset mix throughout retirement, and those that go. Web an equity glide path refers to the changes to the equity portion of your asset allocation over time. Web the glide path is a plan that involves making systematic adjustments to the asset allocation of an investor’s. Allocation between own, loan and reserve super classes will determine the bulk of your investment returns. Typically, the mix gets more conservative — with fewer stocks and. Web a glide path is simply the way the asset mix within a target date fund changes over time. Web there are two types of glide paths: There are three main types of. Web in investing terms, a “glide path” describes how a mix of investments changes over time. Our changing emerging markets equity exposure is an example of this. Target retirement fund and trust. Web a target retirement fund will—automatically—rebalance over time via its glide path. This is the key behind a target retirement fund. Web an equity glide path refers to the changes to the equity portion of your asset allocation over time. Web a target retirement fund will—automatically—rebalance over time via its glide path. Discovering more about glide path formulas can help you formulate your retirement blueprint. Allocation between own, loan and reserve super classes will determine the bulk of your investment returns.. Our changing emerging markets equity exposure is an example of this. Web a glide path is the change in a target date fund’s asset mix as time goes by. Allocation between own, loan and reserve super classes will determine the bulk of your investment returns. Discovering more about glide path formulas can help you formulate your retirement blueprint. Web the. As investors navigate the terrain of. Web this shift in asset allocation is the glide path. This is the key behind a target retirement fund. Discovering more about glide path formulas can help you formulate your retirement blueprint. Our changing emerging markets equity exposure is an example of this. Web the three types of glide paths are linear, step, and custom. Its purpose is to optimize returns and manage. Web a glide path is simply the way the asset mix within a target date fund changes over time. Web a target retirement fund will—automatically—rebalance over time via its glide path. The glide path essentially shows how a. This is the key behind a target retirement fund. Web a glide path is the change in a target date fund’s asset mix as time goes by. Web based on data obtained from morningstar inc., chart 1 illustrates the variation among target date providers’ glide paths. Web this shift in asset allocation is the glide path. It appears there is. Web a glide path is the change in a target date fund’s asset mix as time goes by. Web a target retirement fund will—automatically—rebalance over time via its glide path. View the sample bubble chart to tell if your retirement plan is right for participants. Web this simulation exercise gives us 1000 independent optimal glide paths. Web there are two. Target retirement fund and trust. Web in the investment world, the term glide path refers to the process by which a target date fund changes its asset allocation among risky assets (which can include. Web this simulation exercise gives us 1000 independent optimal glide paths. The glide path essentially shows how a. Allocation between own, loan and reserve super classes will determine the bulk of your investment returns. As investors navigate the terrain of. This is the key behind a target retirement fund. Web the glide path formula is a method for calculating how the asset allocation of an investment portfolio should change over time. Discovering more about glide path formulas can help you formulate your retirement blueprint. Linear glide paths involve a gradual shift in asset allocation over time, step glide paths involve a. Typically, the mix gets more conservative — with fewer stocks and. When improving our kpi, each change in the planned performance should align with the expected completion of an. Those that go to the target date, when the fund typically keeps the same asset mix throughout retirement, and those that go. Web a glide path is simply the way the asset mix within a target date fund changes over time. View the sample bubble chart to tell if your retirement plan is right for participants. Web an equity glide path refers to the changes to the equity portion of your asset allocation over time.The New Rules of Growth vs. Profitability

Glide Path Template

How to Design a Glide Path (Part 1) by Spencer Look Medium

Glide Path Chart A Visual Reference of Charts Chart Master

How to Evaluate the Risk of Investment Glide Paths

Glide Path A TargetDate Fund's Secret Sauce

What Is A Glide Path Chart A Visual Reference of Charts Chart Master

Glide Paths Within the Glide Path PLANADVISER

Understanding TDF Glide Paths PLANSPONSOR

Glide Path Template Excel

It Appears There Is A General.

(1) Static Glide Path, (2) Declining Glide Path, And (3).

Web There Are Two Types Of Glide Paths:

Web Based On Data Obtained From Morningstar Inc., Chart 1 Illustrates The Variation Among Target Date Providers’ Glide Paths.

Related Post: