Cup And Handle Chart

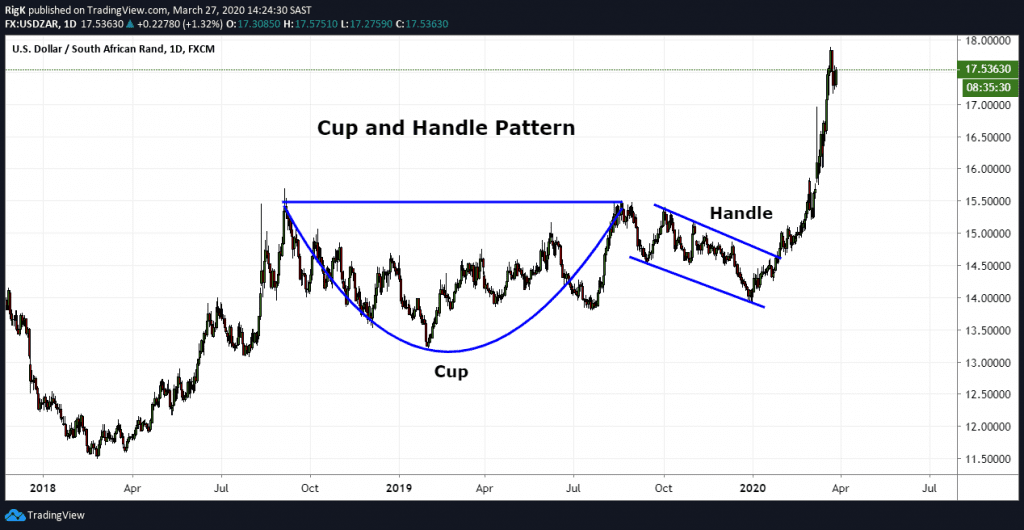

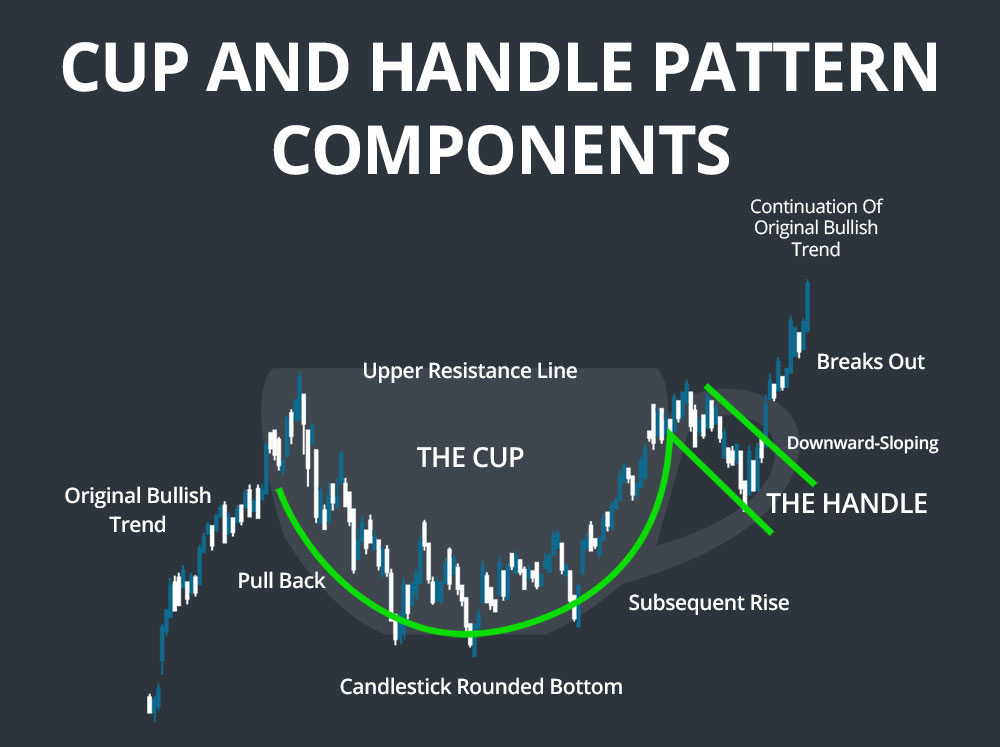

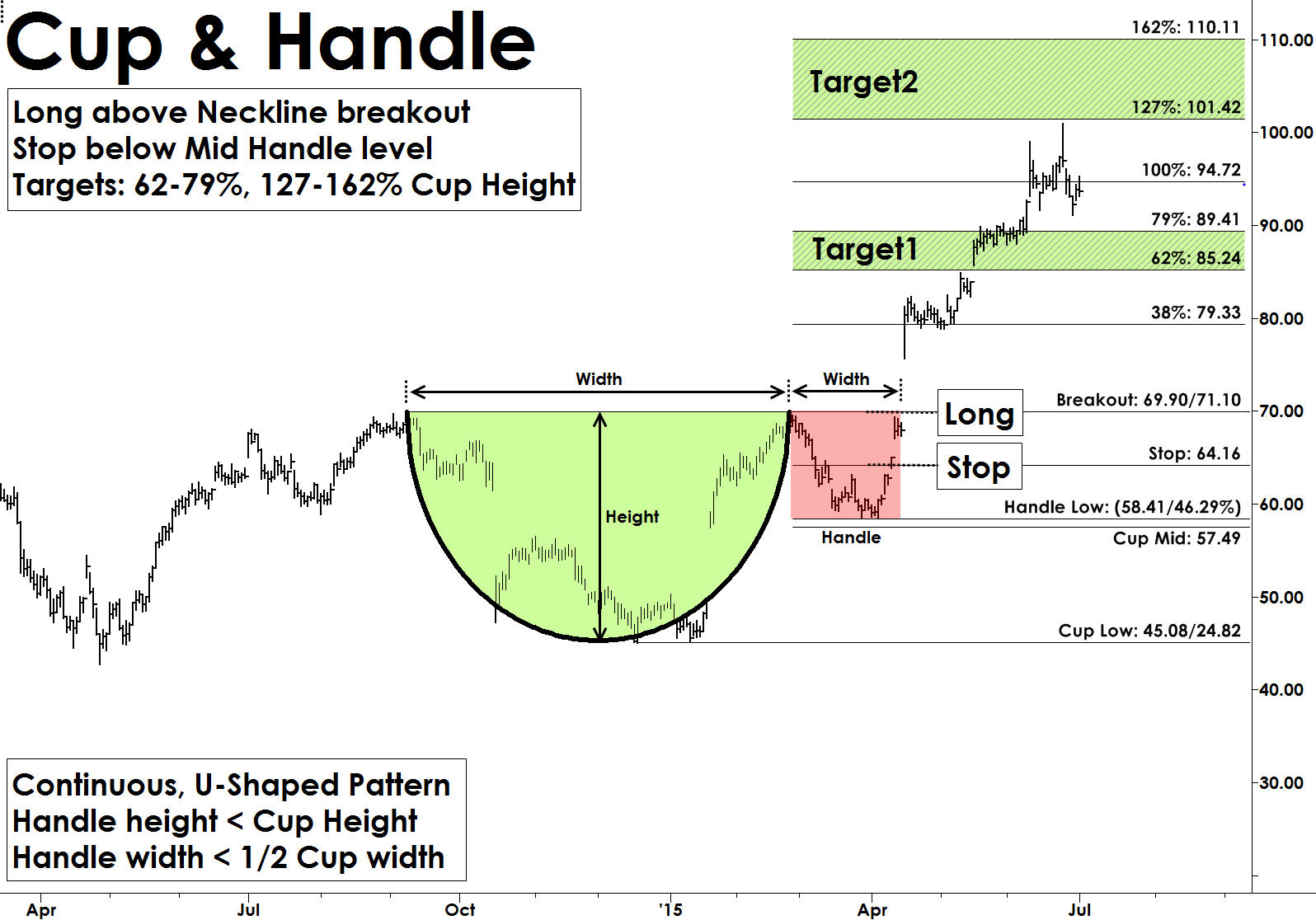

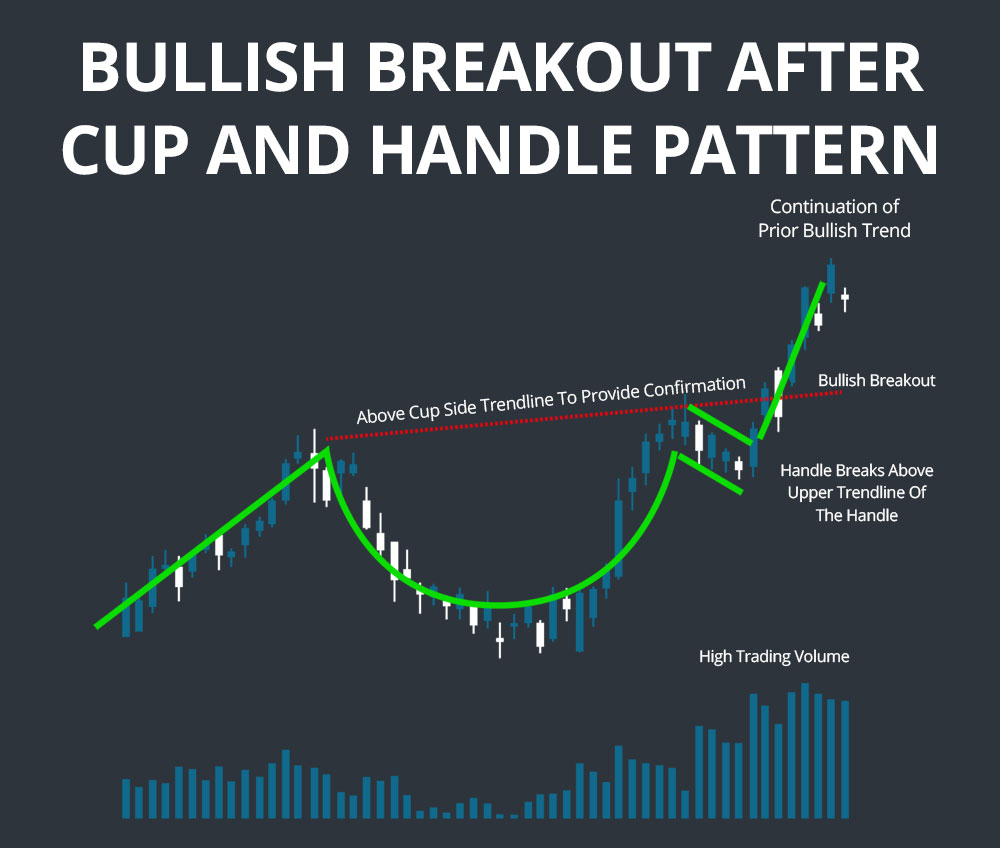

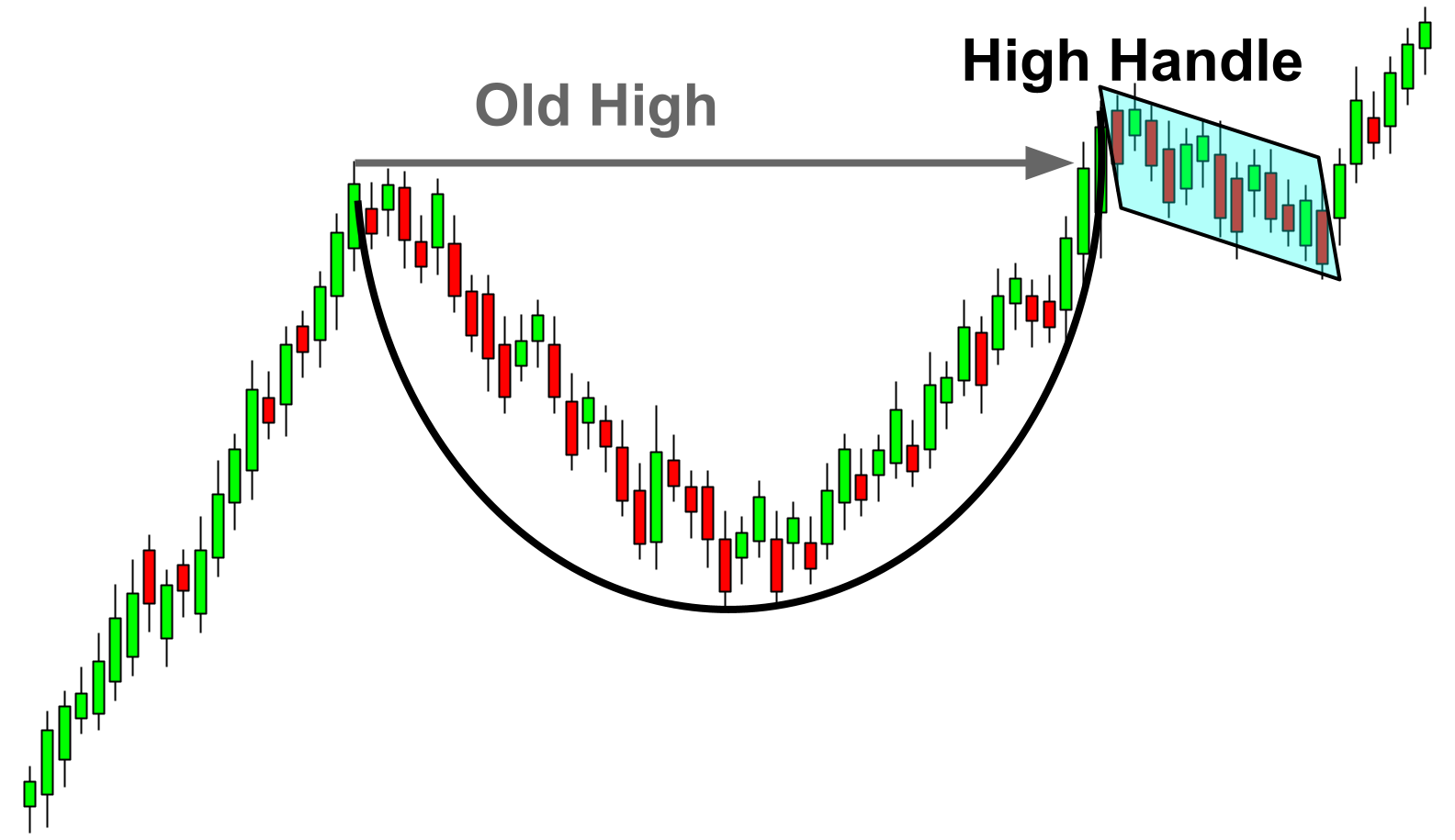

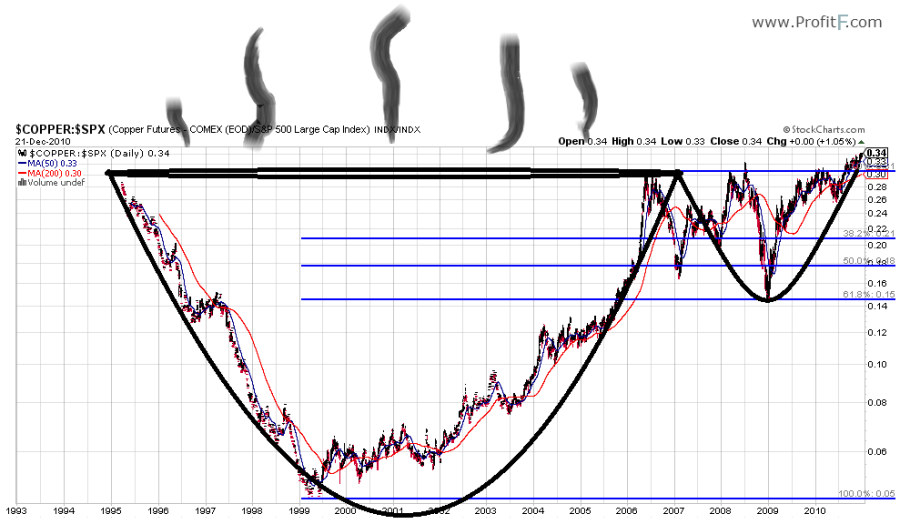

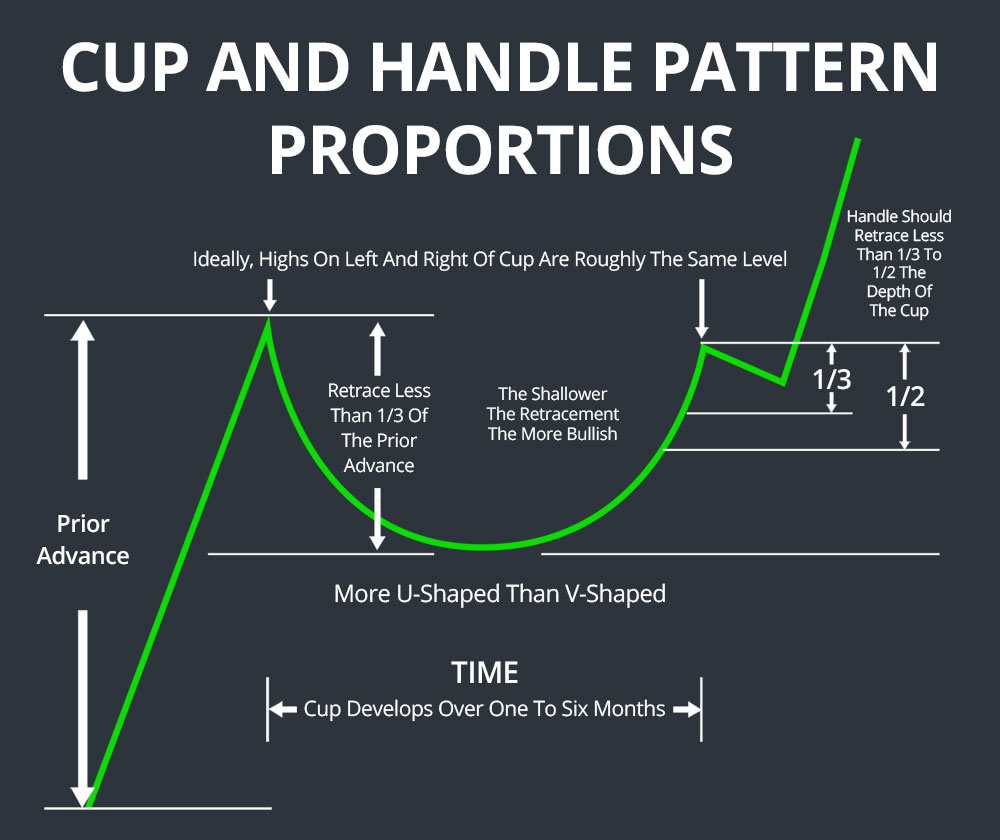

Cup And Handle Chart - It gets its name from the tea cup shape of the pattern. Learn how to read this pattern, what it means and how to trade. Learn how to trade this pattern to improve your odds of making profitable trades. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. Web a cup and handle is a bullish continuation chart pattern that marks a consolidation period followed by a breakout. Web cup and handle patterns are bullish patterns that look like the name they are called. Once the price has found a base, several candlesticks form the rounded cup bottom. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web do you know how to spot a cup and handle pattern on a chart? The pattern gets its name from the visual image it makes on the chart. It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. Here's how to spot and capitalize on the cup and handle. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Web cup and handle patterns are bullish patterns that look like the name they are called. Price moves to a peak level and starts to pull back or fall rapidly. Learn how it works with an example, how to identify a target. Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in this example, a cup and handle. The cup forms after an advance and looks like a bowl or rounding bottom. The cup forms after an advance and looks like a bowl or rounding bottom. Web read fresh tradingview updates: Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Once the price has found a base, several candlesticks form the rounded cup bottom. It gets its. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. The cup forms after an advance and looks like a bowl or rounding bottom. Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in. Discover more in our blog and stay connected with the latest platform news. Here's how to spot and capitalize on the cup and handle. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. Price moves to a peak level and starts to pull back or fall rapidly. Web do you know how. Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in this example, a cup and handle. There are two parts to the pattern: Learn how to trade this pattern to improve your odds of making profitable trades. Once the price has. The pattern gets its name from the visual image it makes on the chart. Then, the price goes back up to the 1st peak level. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. Price moves to a peak level and starts to pull back or fall rapidly. It is considered one. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. The cup and the handle. The pattern gets its name from the visual image it makes on the chart. Learn how it works with an example, how to identify a target. Web cup and handle patterns. It gets its name from the tea cup shape of the pattern. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. A few key factors contribute to forming a cup and handle pattern. Web the cup and handle pattern is a pattern found on stock charts that resembles a,. The pattern gets its name from the visual image it makes on the chart. Web read fresh tradingview updates: Learn how it works with an example, how to identify a target. Web do you know how to spot a cup and handle pattern on a chart? Learn how to trade this pattern to improve your odds of making profitable trades. Cup and handle & inverse cup and handle. Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in this example, a cup and handle. The cup forms after an advance and looks like a bowl or rounding bottom. Web a ‘cup. Web cup and handle patterns are bullish patterns that look like the name they are called. Here's how to spot and capitalize on the cup and handle. Learn how it works with an example, how to identify a target. Web the cup and handle pattern is a pattern found on stock charts that resembles a, you guessed it, cup with. Web a cup and handle is a bullish continuation chart pattern that marks a consolidation period followed by a breakout. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Here's how to spot and capitalize on the cup and handle. The cup and the handle. Learn how to trade this pattern to improve your odds of making profitable trades. Web the cup and handle pattern is a pattern found on stock charts that resembles a, you guessed it, cup with a small handle. A few key factors contribute to forming a cup and handle pattern. Then, the price goes back up to the 1st peak level. Web cup and handle patterns are bullish patterns that look like the name they are called. Web do you know how to spot a cup and handle pattern on a chart? Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. Discover more in our blog and stay connected with the latest platform news. It gets its name from the tea cup shape of the pattern. The pattern gets its name from the visual image it makes on the chart. Learn how it works with an example, how to identify a target.Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Trading the Cup and Handle Chart pattern

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup and handle chart pattern How to trade the cup and handle IG UK

3 Line Break Trade Strategy Characteristics Of Cup And Saucer Pattern

The Cup and Handle Chart Pattern (Trading Guide)

Cup and Handle Patterns Comprehensive Stock Trading Guide

(12/09/20) Trading Bank Stocks Cup&Handle Chart Patterns

Cup and Handle Patterns Comprehensive Stock Trading Guide

Chart Patterns Form When The Price Of An Asset Moves In A Way That Resembles A Common Shape, Like A Rectangle, Flag, Pennant, Head And Shoulders, Or, Like In This Example, A Cup And Handle.

Once The Price Has Found A Base, Several Candlesticks Form The Rounded Cup Bottom.

There Are Two Parts To The Pattern:

Learn How To Read This Pattern, What It Means And How To Trade.

Related Post:

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-bbe9a2fd1e6048e380da57f40410d74a.png)