Bearish Chart Patterns

Bearish Chart Patterns - It suggests a potential reversal in the trend. This reversal pattern can mark the end of a lengthy uptrend. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. A strong downtrend, and a period of consolidation that follows the downtrend. Web the bear pennant consists of two phases: Without further ado, let’s dive into the 8 bearish candlestick patterns you need to know for day trading! Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Web 📍 bearish reversal candlestick patterns : One side is always going to win. It consists of a low, which makes up the head, and two higher low peaks that comprise the left and right shoulders. Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. Channel resistance (taken from the high of 5,325) and a 1.272% fibonacci. If spotted, they’re moneymakers as the head and shoulders top used. They signify the market sentiment is changing from positive to negative and often indicate a possible downtrend. Web along with the potential double top on the rsi indicator from the overbought zone, the chart reversed with a bearish engulfing pattern, and is headed towards the potential support zones: Check out or cheat sheet below and feel free to use it for your training! Bar charts and line charts have become antiquated. This reversal pattern can mark the end of a lengthy uptrend. These patterns are characterized by a series of price movements that signal a bearish sentiment among traders. The psychological $2.00 level may provide initial support, with further. The markets are a tug of war between the bulls and the bears when stock trading. Web from a technical perspective, the market is showing signs of a potential closing price reversal bottom chart pattern. Bearish reversal candlestick patterns can form with one or more candlesticks; Some days, the bulls win. Web in trading, a bearish pattern is a technical. These patterns are characterized by a series of price movements that signal a bearish sentiment among traders. Web the bear pennant consists of two phases: Web a bearish pennant is a pattern that indicates a downward trend in prices. The first indication of an island top is a significant gap up, or sharply higher price at the open, following an. One side is always going to win. Web bearish chart patterns are formed when stock prices start to decline after a period of bullish movement. The former starts when the sellers push the price action lower to create a series of the lower highs and lower lows. It suggests a potential reversal in the trend. Web 📍 bearish reversal candlestick. It consists of a low, which makes up the head, and two higher low peaks that comprise the left and right shoulders. Some days, the bulls win. These patterns are characterized by a series of price movements that signal a bearish sentiment among traders. Without further ado, let’s dive into the 8 bearish candlestick patterns you need to know for. If spotted, they’re moneymakers as the head and shoulders top used. When the pattern occurs in more extended time frames, such as daily and weekly, it tends to affirm the prospect of price reversing from an uptrend to a downtrend. Web bearish candlestick patterns can be a great tool for reading charts. It is one of the shortest bear patterns,. These patterns are characterized by a series of price movements that signal. This pattern suggests a potential reversal of an uptrend, indicating that the price might break to the downside once the pattern concludes. Whether you are a beginner or advanced trader, you want to have a pdf to get a view of all the common chart. They provide technical. It is one of the shortest bear patterns, generally taking just three to five days to form. We see the inverted head and shoulder patterns in major downtrends. Web the rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. It is the opposite of the bullish falling wedge pattern that occurs. Web 5 powerful bearish candlestick patterns. This pattern suggests a potential reversal of an uptrend, indicating that the price might break to the downside once the pattern concludes. These patterns are characterized by a series of price movements that signal a bearish sentiment among traders. These patterns are characterized by a series of price movements that signal. Come learn about. Bar charts and line charts have become antiquated. Web bearish candlestick patterns can be a great tool for reading charts. Comprising two consecutive candles, the pattern features a. They provide technical traders with valuable insights into market psychology and supply/demand dynamics. Check out or cheat sheet below and feel free to use it for your training! Bearish reversal candlestick patterns can form with one or more candlesticks; Web bearish candlesticks are one of two different candlesticks that form on stock charts: Some days, the bulls win. But the good news is that we can review the lessons of market history and notice what consistent patterns have occurred at previous market topics. It is the opposite of. Bearish reversal candlestick patterns can form with one or more candlesticks; It’s formed by connecting higher highs and even higher lows, converging to a point termed the apex. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. A strong downtrend, and a period of consolidation that follows the downtrend. One side is always going to win. This reversal pattern can mark the end of a lengthy uptrend. They signify the market sentiment is changing from positive to negative and often indicate a possible downtrend. Web the s&p 500 gapped lower on wednesday and ended the session at lows, forming what many candlestick enthusiasts would refer to as an ‘evening star candlestick pattern’. Whether you are a beginner or advanced trader, you want to have a pdf to get a view of all the common chart. When the pattern occurs in more extended time frames, such as daily and weekly, it tends to affirm the prospect of price reversing from an uptrend to a downtrend. Bar charts and line charts have become antiquated. It is one of the shortest bear patterns, generally taking just three to five days to form. These patterns are characterized by a series of price movements that signal. This pattern suggests a potential reversal of an uptrend, indicating that the price might break to the downside once the pattern concludes. Web chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency trading ).bearishreversalcandlestickpatternsforexsignals Candlestick

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

Bearish Candlestick Reversal Patterns Stock trading strategies

Bullish And Bearish Chart Patterns

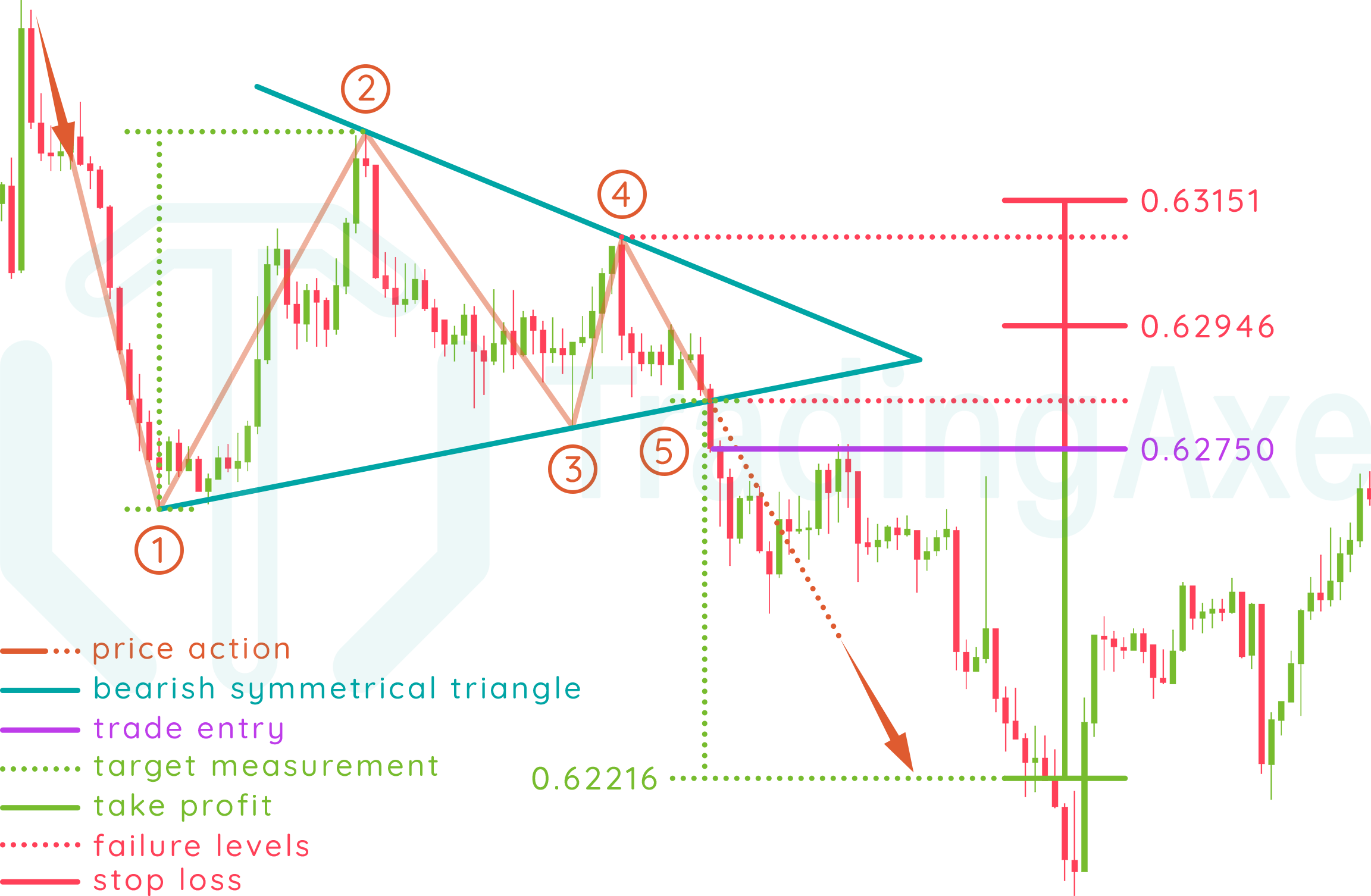

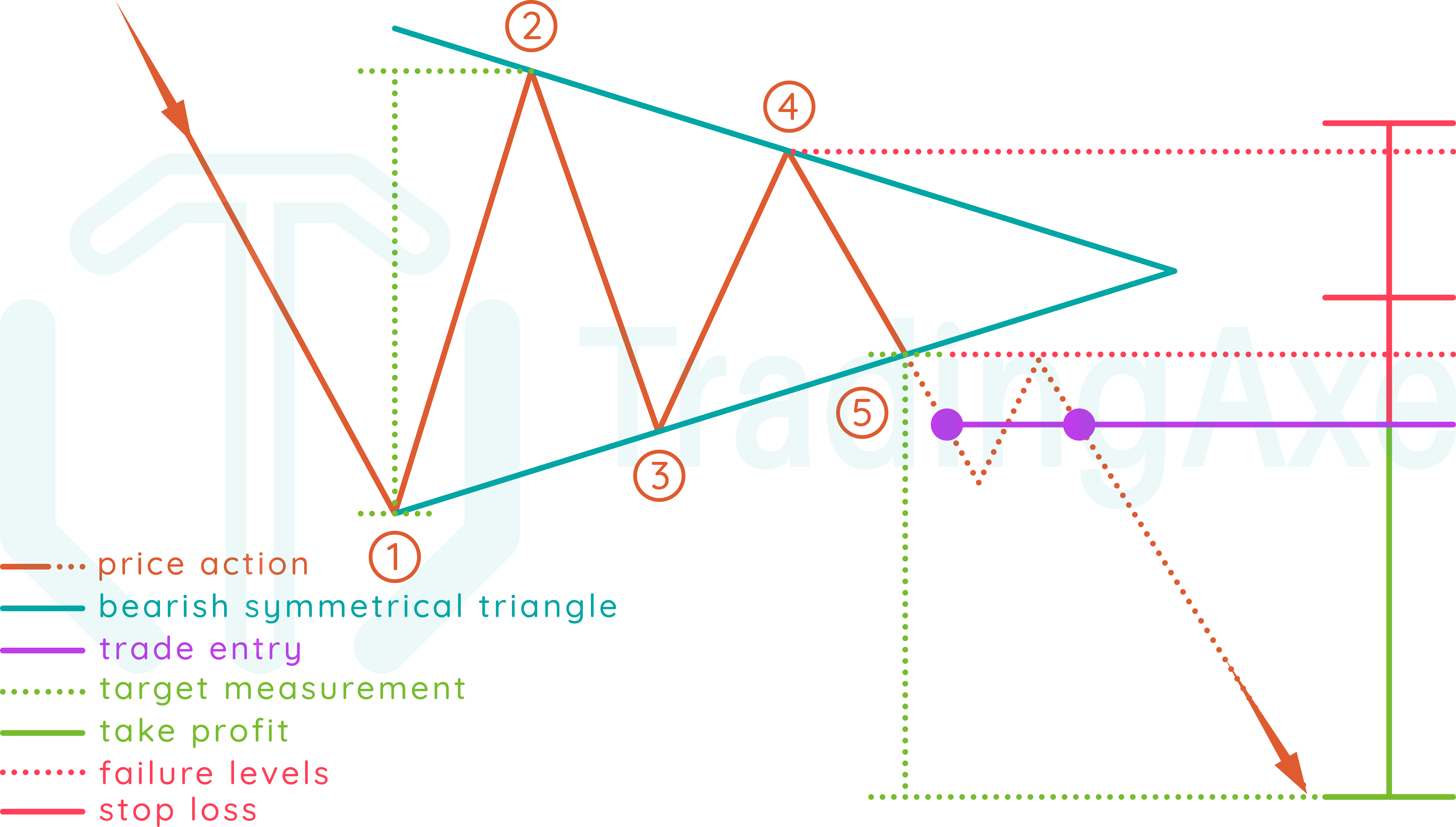

How To Trade Bearish Symmetrical Triangle Chart Pattern TradingAxe

Bearish Reversal Candlestick Patterns The Forex Geek

Candlestick Patterns Cheat Sheet Bruin Blog

How To Trade Bearish Symmetrical Triangle Chart Pattern TradingAxe

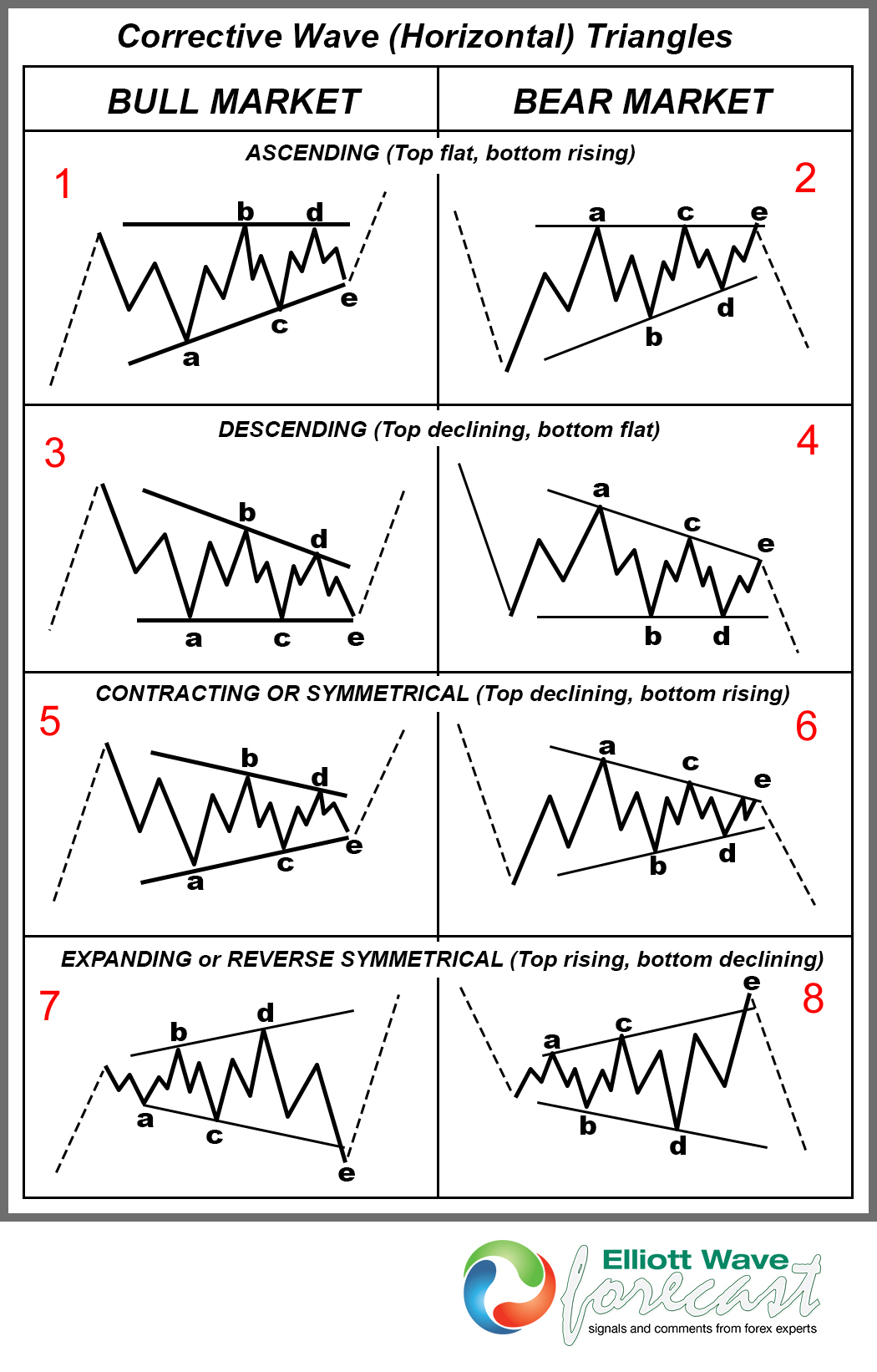

Types Of Triangle Chart Patterns Design Talk

Mastering Trading Our Ultimate Chart Patterns Cheat Sheet

Candlesticks Have Become A Much Easier Way To Read Price Action, And The Patterns They Form Tell A Very Powerful Story When Trading.

Without Further Ado, Let’s Dive Into The 8 Bearish Candlestick Patterns You Need To Know For Day Trading!

Web In Trading, A Bearish Pattern Is A Technical Chart Pattern That Indicates A Potential Trend Reversal From An Uptrend To A Downtrend.

Web The Bear Pennant Consists Of Two Phases:

Related Post:

.png)